| Autorius | Žinutė |

| 2011-10-21 22:25 #223661 | |

|

"Eurozone ministers approve 8bn euro Greek bailout aid" BBC

|

|

|

|

2011-10-24 21:05 #224079

1 1

|

|

augisss [2011-09-30 23:00]: deivisss,juk principas yra tendencijose,o pozicijos gali keistis daznai.labai daznai arba dar kazkaip kitaip.Visko juk negali kasdien postinti,o ir nematau reikalo.Jau rasiau,kad pardaviau auksa.Kiek per anksti.Pardaviau chf.Beveik idealiai.Pirkau usd.Pirksiu sidabra,jei bus 17-20 intervale,o dabar keiciu shortus i longus akcijose.Manau,kad nuo 1080-1100 galim gerokai paraliuoti.  spektras,ar longini infliacija? |

|

| 2011-10-25 14:19 #224219 | |

|

An Overview of the Euro Crisis

įdomioji infografika: http://www.nytimes.com/interactive/2011/10/23/sunday-review/an-overview-of-the-euro-crisis.html Print Version: http://www.nytimes.com/imagepages/2011/10/22/opinion/20111023_DATAPOINTS.html?ref=sunday-review |

|

| 2011-10-25 14:56 #224229 | |

|

spektras,ar longini infliacija? augisss,jau minėjau,kad pasinėręs išskirtinai dienos prekyboje.Todėl vienu metu daug atvirų pozicijų.Dažnai į abi puses. |

|

|

|

2011-10-25 21:06 #224339 |

|

spektras

Ir as taip dariau anksciau.Ir dabar turiu poziciju i abi puses,bet dauguma kolkas longe.Nebeturiu tiek laiko buti prie kompo.Gal kai isesiu i pencyjun. O dabar ziurim usd index.76.I kuria puse ryskiau persisvers,ten ir keliausim. |

|

| 2011-10-27 12:27 #224777 | |

|

gan paprastai isdestyti visi "nuts and bolts":

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/8830072/Europes-lost-decade-as-7-trillion-loan-crunch-looms.html |

|

|

|

2011-11-03 18:11 #226036 |

|

British bookmaker William Hill is offering odds of 4/6 that Greece will cease to use the euro by the end of 2012, AFP reports. "For the first time we are betting odds-on that the Greeks will quit the euro," said spokesman Graham Sharpe.

Gal kas susigundysit: http://sports.williamhill.com/bet/en-gb/betting/g/672122/Eurozone-To-Break-Up.html p.s. beje ką tik parvažiavau iš Graikijos, labai graži šalis... |

|

2011-11-04 05:45 #226107

1 1

|

|

|

labai logiska, tiesiog follow the money ir bus aisku kodel referendumas gruodzio pradzioje. Bookmakeriai siuo atveju net visus metus rezervo pasilieka

vien gruodzio men. Graikijai reikia "sukrapstyti" virs 12b.

|

|

| 2011-11-09 01:07 #227432 | |

|

labai patiko trumpa siapzvejo zinute "Lietuvos eko krizej" kaip atrodo situacija LT verslo akimis.

Cia panasus labai realus zvilgsnis (deja, is "antru lupu") kaip graiku verslas (laivyba) mato situacija salyje: The situation today is worse than ever. Business has stopped. The world does not appreciate the extent of social deterioration in the country. Soup kitchens are forming to feed people. Many old age homes are desperate. Many are indebted. The have been pleading for donations. Wealthy ship owners have been discussing a private initiative to provide support for those on the edge. There is no possibility for a unity government. There is less chance for this in Greece then there is in the USA. You think there is a problem between Democrats and Republicans? Here, they hate each other. Papandreou was desperate to get out. He could not see how he could continue to play a confrontational role with the Greek people. He was losing his ability to maintain civil order. He did not want to govern a country that was going to become either a police state, or fall into a state of revolution. An interim government may pass new laws and make promises to the EU and IMF. Most in the government want to stay in the EU and stick with the Euro. It’s in their best interests to do so. That’s what the EU is pushing them day and night to do. It’s way to late for this type of orderly transition. It will end badly for Greece. |

|

2011-11-09 02:04 #227444

3 3

|

|

|

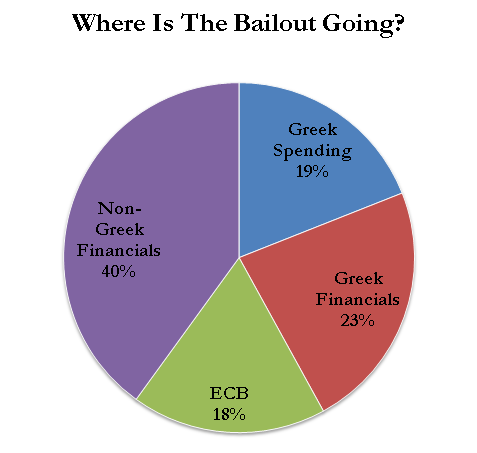

kurgi dingsta eilinio bailout'o pinigai?

In the end less than 19 cents of the bailout are going to allow Greece to continue its overspending. About 23 cents goes to Greek institutions, though at this point, all of that is held by the ECB, so it is not fully benefiting Greece. 18 cents are going to the ECB directly and 40 cents are going to banks and insurance companies outside of Greece. So at least 58 cents of every bailout Euro is going outside of Greece, and depending on how you treat the repo agreements, that number could easily be 70 cents  So yes, Greece is getting a bailout, but you can see why Merkozy got so scared at the idea of a referendum. The bulk of the money that Greece is "getting" comes right back to the rest of the EU. Whatever posturing is going on, Greece will get away without meeting any of its stated goals, or at least it will until the EU decides it has written down enough principal and that the ECB can handle the shock. It is an interesting way to look at it, and confirms who really has the problem with a Greek default - and it's not Greece. p.s. ironiska, bet Europines paramos Lietuvai matematika irgi gana panasi (tik grizta labiau per korporate sektoriu). Idealus verslo planas- investuota kapitala susigrazini max per 5 metus, ir dar salis lieka tau skolingas "iki gyvos galvos". Va cia tai bent produktyvaus finansinio turto sukurimas! |

|

|

|

2011-11-09 07:09 #227448 |

|

siaures vejas [2011-11-09 01:07]: Papandreou was desperate to get out. He could not see how he could continue to play a confrontational role with the Greek people. He was losing his ability to maintain civil order. He did not want to govern a country that was going to become either a police state, or fall into a state of revolution. Manau Papandreo pasitraukimas yra teigiamas zingsnis, ir man suprantamas tų turtingų graikų laivų savinkų susirūpinimas. Nesuprantama yra kaip Papandreo neatėjo į galvą pasodinti keletą tų lavų savininkų ir konfiskuoti jų ir jų giminaičių bei meilužių turtą - tauta greitai apsiramintų, ir biudžete pinigų atsirastų. |

|

| 2011-11-09 09:28 #227459 | |

|

Pasak Barclays Capital, Italija jau perzenge 'Point of no return'.

Pagrindines mintys: 1) At this point, it seems Italy is now mathematically beyond point of no return 2) While reforms are necessary, in and of itself not be enough to prevent crisis 3) Reason? Simple math--growth and austerity not enough to offset cost of debt 4) On our ests, yields above 5.5% is inflection point where game is over 5) The danger:high rates reinforce stability concerns, leading to higher rates 6) and deeper conviction of a self sustaining credit event and eventual default 7) We think decisions at eurozone summit is step forward but EFSF not adequate 8) Time has run out--policy reforms not sufficient to break neg mkt dynamics 9) Investors do not have the patience to wait for austerity, growth to work 10) And rate of change in negatives not enuff to offset slow drip of positives 11) Conclusion: We think ECB needs to step up to the plate, print and buy bonds 12) At the moment ECB remains unwilling to be lender last resort on scale needed 13) But frankly will have hand forced by market given massive systemic risk Nuoroda: Barclays Capital Economic Research - Can Italy save itself? |

|

2011-11-09 11:12 #227505

2 2

|

|

|

patogi priemone:

http://www.google.com/publicdata/directory |

|

| 2011-11-09 13:19 #227571 | |

|

viso gero Italija?

Italijos valstybinių obligacijų pajamingumas jau pasiekė faktiškai tokį patį lygį, po kurio tiek Graikija, tiek Airija bei Portugalija turėjo kreiptis pagalbos į euro zonos partnerius bei į Tarptautinį Valiutos Fondą. http://www.traders.lt/page.php?id=12837 |

|

|

|

2011-11-09 13:24 #227574 |

|

jei ECB nepradės agresyviai supirkinėt Italijos bondų, bus kajukt ...

|

|

| 2011-11-09 13:30 #227577 | |

|

o idomu ar Lietuvos vyriausybe turi plana , jei euro nebeliks? O ko italai nori , pagyveno ES saskaita. Tai dabar reikia skolas grazinti.Gerai kad Lietuva ne euro zonoj. Reiketu kaip estams islaikyti pietu valstybes. O siaip tai rinkos sokineja visai geras laikas.

|

|

| 2011-11-09 13:36 #227580 | |

|

Italijos uzlinkimas, cia ne koks mazas pirstelejimas, todel panele Merkel turetu nustoti elgtis kaip maza nekalta mergaite ir imti darbuotis is pagrindu, t.y. pradeti spausdinti eurus....

|

|

|

|

2011-11-09 13:55 #227588

1 1

|

|

vokiečiai ne labdaringa organizacija, jų tikslas ne pietiečių skolas nurašyt, o tas šalis ant kelių prieš Vokietiją paklupdyt ir politiškai bei finansiškai nuo Vokietijos priklausomas padaryt ... Graikai jau klūpi, dabar eilė atėjo italams ... belieka žavėtis britų ir skandinavų toliaregiškumu, nesijungiant prie euro zonos

|

|

| 2011-11-09 13:59 #227590 | |

|

na tas tiesa, plius silpnas euras yra palankus vokietijos eksportuotojams...

|

|

2011-11-09 14:24 #227604

1 1

|

|

|

IT17 [2011-11-09 13:36]: Italijos uzlinkimas, cia ne koks mazas pirstelejimas, todel panele Merkel turetu nustoti elgtis kaip maza nekalta mergaite ir imti darbuotis is pagrindu, t.y. pradeti spausdinti eurus.... aciu merkel kad ji turi vidini stabdi(nespausdina beverciu euriuku).darbuotis ish pagrindu turi ne kas kitas o tie '' nusizenge '' (graikija airija ir tt.) . sisstema nesugrius bet priversti '' pasiklydelius '' darbuotis tikrai privers! |

|